BC Assessment has just released the 2024 property values, and here’s the scoop: homes, condos, and townhomes in Abbotsford have seen a 3% drop in assessed values. For example, the average assessed value for a single-family home went from $1.172 million in July 2022 to $1.139 million in July 2023. Condos and townhomes also dropped from $495,000 to $480,000.

If you own a property in the Lower Mainland, keep an eye out for your 2024 assessment notice based on market values as of July 1, 2023. The housing market seems to be leveling out, with most homeowners expecting modest changes between -5% and +5%.

New construction, subdivisions, and rezoning contribute around $27.2 billion to the updated assessments.

Looking at the numbers, the average value of a single-family home in the City of Vancouver has risen by 4% in the past year, hitting $2.209 million. Little change in average property values in big communities across B.C. Graph below shows change in “Assessed value” from 2023 to 2024 as of July 1 of 2023.

If you feel you’ve been unfairly assessed compared to neighboring properties, you can submit an appeal for review by January 31, 2024.

Assessment Value vs. Market Value

First of all, your assessment value is like a snapshot in time, specifically from July 1st of the previous year. We all know how much our market can change in 6 months’ time. Since most of the assessment process is done online, an appraiser rarely, if ever, visits a home to assess it in person, meaning assessment values don’t always factor in all those amazing

renovations, unique interior layouts, or any modifications you’ve made. Your home is unique and its Market value reflects that.

BC assessment is essential for property tax purposes, it likely doesn’t tell you the true

value if you wanted to sell it today.

How do Property Taxes correlate with the Assessed Value?

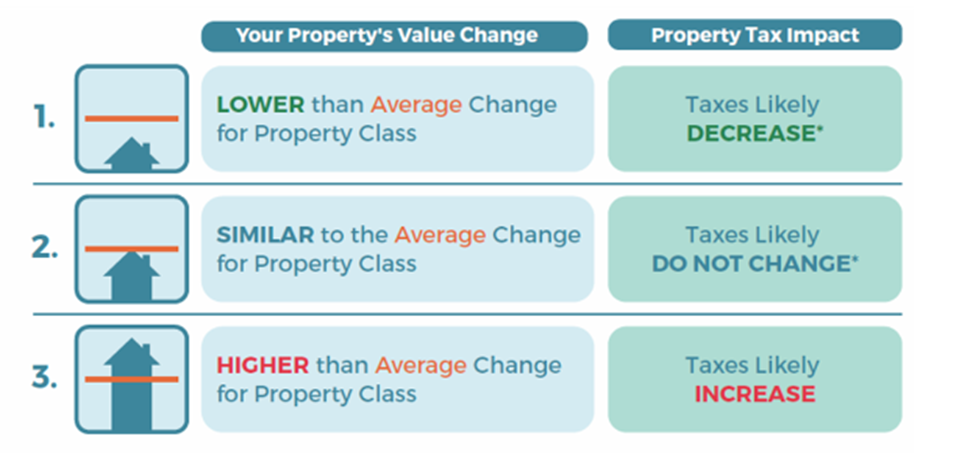

A big change in your property’s assessed value doesn’t necessarily mean a big change in your taxes. What matters is how your property’s value compares to the community/neighboring properties average. How your assessment changes relative to the average change in your community is what may affect your property taxes.

This year the City of Abbotsford is looking at a 5.12% increase in property taxes – the highest its been in the recent years.

Since property taxes are based on a home’s assessed value, only those properties with values that rise (or fall) exactly in line with the city average will see the average tax increase.

Residents whose property values drop, compared to the city average, will see a smaller increase – or even a decrease. Meanwhile, those whose home’s value increases more than the city average will end up paying more in tax.

Should you appeal?

If you believe your property was assessed inaccurately there is no harm in appealing for review.

How to Appeal?

- Gather evidence that shows the comparison between the assessed value of your home to the neighboring properties. Establish a good point of comparison, such as price per sq.ft. of house or price per sq.ft. of land and put together a persuasive argument. You can use this website, to compare your assessment to neighboring properties

- Contact BC Assessment (1-866-825-8322) to speak with an appraiser addressing your concerns about your assessment. If you and the appraiser agree there is an error, the assessment can be corrected without an independent review.

- Appeal for review: If your request was not satisfied you are able to submit an appeal. To request a review, you must submit your written request to your local BC Assessment office no later than January 31.

- Hearings & Panel Decisions take place

For more information, visit: PARP complaint (appeal) guide (bcassessment.ca) for a complete step-by-step in submitting an appeal.

Key Dates

Submit Appeal and Request a Review: January 31, 2024

Hearings: Between February 1 and March 15

Panel Decisions: All decisions must be rendered before March 16. In either case, you will receive a formal Decision Notice which BC Assessment is required to mail to you by April 7.

If you have any further questions or would like to chat about your assessment, feel free to reach out to us!

Resources:

BC Assessment – Independent, uniform and efficient property assessment

To appeal or not to appeal? Expert advice for dealing with your new property assessment | CBC News

Most home values flattening after years of sharp increases, B.C. Assessment data shows | CBC News

City looking at property-tax increase of 5.12% in Abbotsford – The Abbotsford News (abbynews.com)